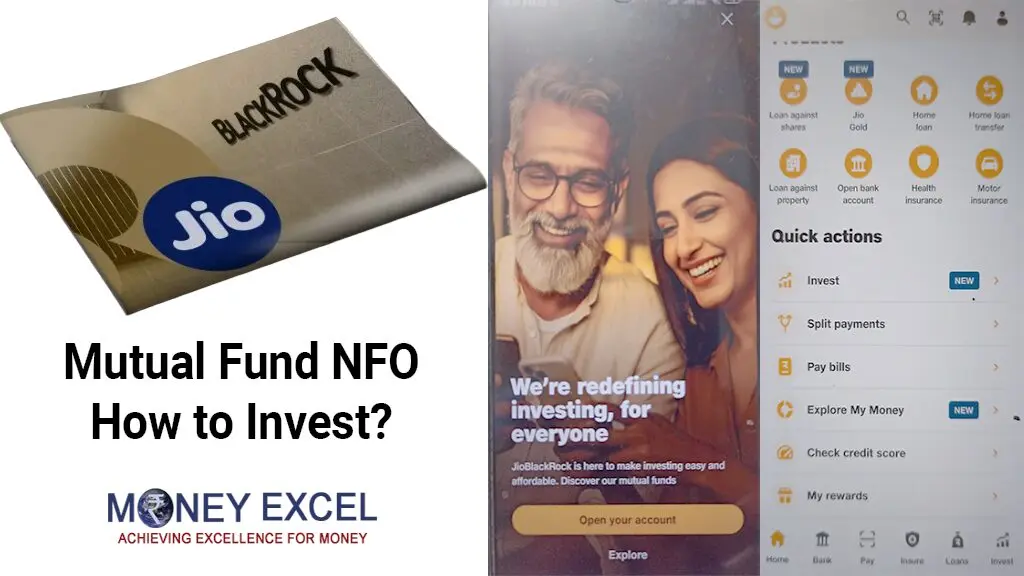

What is Jio BlackRock Mutual Fund?

Jio BlackRock Mutual Fund is a new-age investment platform launched by Jio Financial Services in partnership with global asset manager BlackRock. This venture offers mutual funds tailored for Indian investors with low entry barriers, digital KYC, and easy-to-use apps.

![Download Teen Patti Master [Video Game] Now](https://teenpattimasterapkinstall.com/wp-content/uploads/2025/06/teen-patti-master-download-300x92.webp)

Queries :

Jio BlackRock Mutual Fund apply online

How to invest in Jio BlackRock Mutual Fund

Jio BlackRock SIP start

Jio BlackRock withdrawal process

Jio BlackRock KYC steps

Jio BlackRock direct mutual fund plans

Is Jio BlackRock mutual fund safe?

Jio mutual fund app download

Jio financial services mutual fund review

Jio BlackRock ELSS tax saving fund

How to Apply for Jio BlackRock Mutual Fund (Step-by-Step)

Step 1: Download the App or Visit Website

App: Search for “Jio BlackRock Mutual Fund” on Play Store or App Store

Website: www.jiofinancialservices.com

Step 2: Complete eKYC

Enter your mobile number

Verify using Aadhaar and PAN

Upload a selfie, enter your bank details

Done in 5 minutes

Step 3: Choose a Mutual Fund

Select type: Equity, Debt, Hybrid, ELSS

Use goal-based suggestions or risk profile quiz

Step 4: Start Investing

Choose SIP (Systematic Investment Plan) or Lump Sum

Start with just ₹100–₹500

Pay via UPI / Net Banking

![Download Teen Patti Master [Video Game] Now](https://teenpattimasterapkinstall.com/wp-content/uploads/2025/06/teen-patti-master-download-300x92.webp)

How to Withdraw Money from Jio BlackRock Mutual Fund?

Step-by-step:

Open app > Go to “Investments”

Select the fund you want to redeem

Click on “Withdraw” or “Redeem”

Enter amount (full or partial)

Confirm – money will be transferred to your bank in T+1 or T+3 working days

Note:

Some funds may have an exit load if withdrawn early (usually within 1 year)

Features of Jio BlackRock Mutual Fund

| Feature | Details |

|---|---|

| Fully Digital | Paperless KYC & investments |

| Low Entry Barrier | Invest from ₹100 |

| Risk Profile Tool | Helps choose right fund |

| Tax Saving Options | ELSS mutual funds under 80C |

| SIP & Auto-debit | Set monthly investments |

| Safe & Regulated | Approved by SEBI & AMFI |

Pros & Cons

Pros:

Trusted brands: Jio + BlackRock

Easy to start, great UI

Safe, SEBI-regulated

Wide range of funds

Tax benefits via ELSS

Cons:

New platform (less historical data)

Limited fund range (initial launch phase)

Requires basic financial knowledge

Frequently Asked Questions (FAQs)

1. Is Jio BlackRock Mutual Fund safe?

Yes. It’s regulated by SEBI, and backed by Reliance’s Jio Financial Services and BlackRock – one of the world’s largest asset managers.

2. Can I invest without a PAN card?

No. PAN is mandatory for mutual fund KYC as per SEBI rules.

3. Is there a lock-in period?

Only for ELSS funds (3 years lock-in). Other funds can be withdrawn anytime.

4. How much can I start with?

You can start with as little as ₹100–₹500.

5. What are the charges?

If you choose Direct plans, there are no commissions. Some funds may have exit load or expense ratio (small annual % fee).

6. Can I change my SIP amount?

Yes, you can modify or stop your SIP anytime from the dashboard.

7. What is the difference between SIP and Lump Sum?

SIP = Small fixed amount monthly

Lump sum = One-time big investment

Popular Search Intent Topics Answered

How to download Jio BlackRock Mutual Fund app?

Go to Play Store or App Store and search “Jio BlackRock Mutual Fund”.

How to cancel SIP in Jio BlackRock?

Open app > Go to SIPs > Select SIP > Click “Cancel”.

How to transfer mutual fund from other platform to Jio BlackRock?

Use Consolidated Account Statement (CAS) or contact support for fund migration (only for supported schemes).

Who Should Invest in Jio BlackRock?

✅ New investors

✅ Salaried professionals (SIPs)

✅ Tax planners (ELSS funds)

✅ Long-term investors

✅ Tech-savvy millennials

Final Verdict: Should You Invest?

Yes – if you want:

Low-cost, paperless investment

Trusted and transparent platform

Beginner-friendly experience

But always research or consult a SEBI-registered advisor before investing.

Read More : Jio Teen Patti Master

Jio Finance App | Teen patti master Apps | Yono Apps